KUALA LUMPUR — Setiawangsa PKR division chief Datuk Afdlin Shauki has called on the government to conduct a comprehensive review of the proposed merger between Sunway Berhad and IJM Corporation Berhad, following the conglomerate’s official announcement of a takeover offer valued at approximately RM11 billion.

According to Afdlin, the proposed mega transaction is not merely a routine corporate exercise, but one that carries significant implications for public and Bumiputera equity ownership, potentially transferring control of a strategic, publicly owned company into the hands of a privately controlled conglomerate led by tycoon Tan Sri Jeffrey Cheah.

“A Big Story That Has Gone Quiet”

Afdlin noted that despite the multibillion-ringgit scale of the proposed merger, the issue has not received the level of public scrutiny it warrants.

“Many see this as just another big business deal. In reality, this is where the future of the people’s economic interests is being decided,” he said.

He stressed that beyond corporate buzzwords such as synergy and operational efficiency, the fundamental question remains whether the merger genuinely serves public interest — or merely consolidates wealth and power among a small elite.

RM11 Billion Deal That Reshapes Ownership Structure

Sunway Bhd has announced a conditional voluntary takeover offer for IJM Corporation Bhd with a total implied value of about RM11 billion — a move that would create Malaysia’s largest property and construction conglomerate in terms of revenue and asset base.

Under the proposed terms, IJM shares are priced at RM3.15 each, representing a 14.55% premium over the last traded price of RM2.75. The consideration comprises 10% cash and 90% new Sunway shares issued at RM5.65 apiece.

For every 1,000 IJM shares held, shareholders would receive RM315 in cash and approximately 501 Sunway shares, with a total implied value of around RM2,835. The RM1.1 billion cash component will be funded through a mix of debt financing and internal funds.

IJM Is Not Privately Owned — It Belongs to the People

Afdlin emphasised that IJM is not an ordinary listed company, as its ownership is largely anchored by government-linked investment institutions and public trust funds.

“IJM is not a private company. It is substantially owned by public trust institutions,” he said.

Among IJM’s major shareholders are:

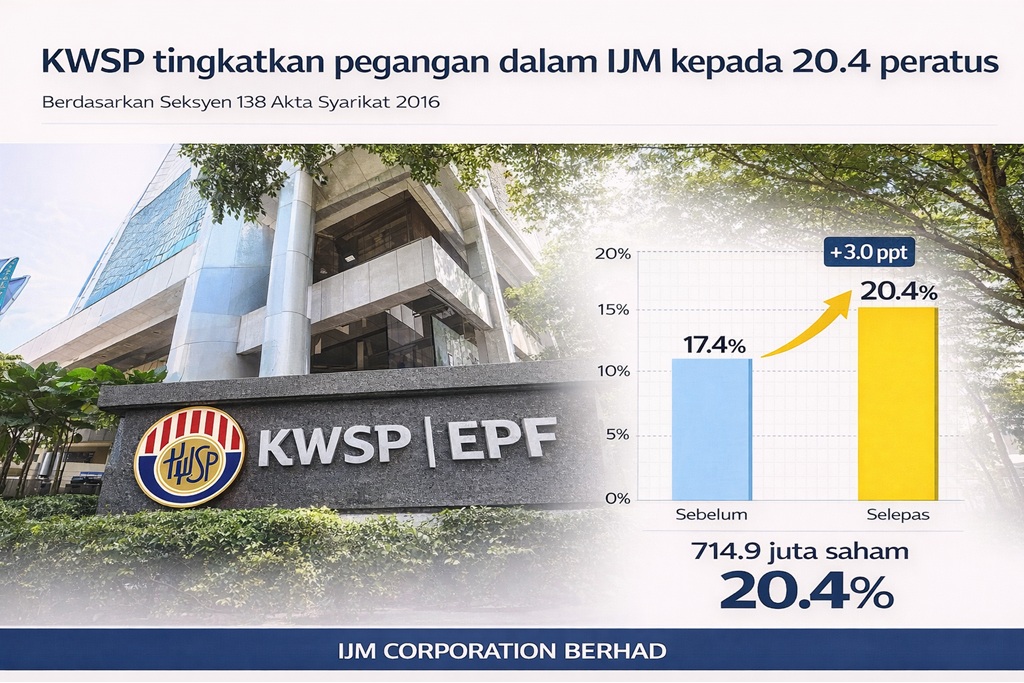

- Employees Provident Fund (EPF) — 18.04%

- Permodalan Nasional Berhad (PNB) — 14.55%

- KWAP, Tabung Haji, Amanah Raya and ASB-linked funds, all holding significant stakes

“This means IJM was built using Malaysians’ retirement savings, trust funds and long-term investments — the majority of which belong to Bumiputera contributors,” he added.

He warned that converting IJM holdings into Sunway shares through the takeover mechanism would effectively shift control of strategic public assets to a private conglomerate, weakening Bumiputera representation in Malaysia’s corporate ownership structure.

Delisting Risk: Silencing the Public Voice

More critically, Sunway has stated that if acceptances reach 90% or more, it intends to invoke compulsory acquisition of the remaining shares and proceed with delisting IJM from Bursa Malaysia.

Sunway also indicated that it does not intend to rectify any shortfall in public shareholding spread, potentially resulting in IJM operating as a private entity.

“When a company is privatised, transparency is lost, public oversight disappears, and the people’s voice — as represented through the capital market — is effectively silenced,” Afdlin said.

Concerns Over Excessive Corporate Concentration

Afdlin also expressed concern over the concentration of economic power that would arise should Sunway — already controlled by Tan Sri Jeffrey Cheah — be merged with IJM, particularly within the construction sector.

Sunway, which already owns universities, hospitals, hotels, shopping malls and its own construction arm, would emerge as a dominant force post-merger, surpassing other major industry players such as Gamuda and UEM.

“In the construction industry, more than 90% of players are small and medium-sized contractors, most of them Bumiputera-owned. When one giant controls too much, smaller players are inevitably squeezed out,” he said.

Questions Directed at Public Trust Institutions

Afdlin also questioned the stance of EPF, PNB and Tabung Haji, describing them as trustees of millions of Malaysians.

“If these institutions support the merger without demanding clear safeguards for Bumiputera interests and local vendors, this ceases to be an investment issue — it becomes a matter of trust,” he said.

In Line With the Prime Minister’s Own Warnings

He noted that Prime Minister Datuk Seri Anwar Ibrahim has previously warned against allowing strategic public assets to fall into the hands of the ultra-wealthy, especially at a time when ordinary Malaysians continue to struggle with rising living costs.

“If that warning is to be taken seriously, the government must pause, investigate and reassess this proposal before it is finalised,” he said.

“This Is Not Politics — This Is About the Future”

In closing, Afdlin stressed that the issue transcends political divisions.

“This concerns our EPF savings, our families’ ASB investments, Tabung Haji deposits, and the employment prospects of future generations,” he said.

The mega transaction is expected to be completed in the third quarter of 2026, with UBS AG Singapore acting as International Financial Adviser and Maybank Investment Bank serving as Principal Adviser to Sunway.

The real question now, Afdlin argued, is not whether the deal is legally permissible, but whether it is fair to the people and Bumiputera stakeholders who have long formed the backbone of IJM’s ownership.